The preliminary bidding to acquire South Korea’s auto parts supplier Hanon Systems Corp. has drawn overseas-based bidders only, with the strong domestic candidates -- LG Group and the company’s former owner Halla Group -- opting out of the race at the very last minute.

Hanon’s current owners, Hahn & Co. and Hankook Tire & Technology Co., are

selling 69.99% of Hanon shares at an estimated asking price of more than 7 trillion won ($6.2 billion). The PE firm

Hahn & Co. holds 50.5% of Hanon’s shares, whereas

Hankook Tire holds another 19.49%.

According to the investment banking industry on June 22, around five firms made preliminary bids for the deal that is set to be the country’s largest M&A transaction this year.

The bidders include global PE firms such as The Carlyle Group and Bain Capital, as well as major global players in the auto sector, including France’s automotive supplier Valeo SA and Germany’s auto parts maker Mahle GmbH.

Valeo is the world’s third-largest thermal management systems supplier for automakers with a 12% market share, just behind Hanon’s 13%. Japan’s Denso is the leading player with 28% control of the market.

While Valeo and Bain Capital made separate bids in the preliminary round today, sources say that the two firms are in discussion to form a consortium for the acquisition.

Germany’s Mahle, the fourth-largest player in the segment with an 11% share, joined the race for the acquisition with Deutsche Bank as its financial advisor.

Mahle is globally known more for its combustion engine systems and components. The company entered the thermal management systems market in 2015 by acquiring Delphi Thermal from the US automotive supplier Delphi Automotive Plc, now renamed as Aptiv Plc. Sources report that Mahle is also trying to set up a consortium with a global PE firm.

Analysts say that the major PE firms that have joined the bidding need to form an alliance with an auto components firm such as Valeo and Mahle considering their close business relations with the global automakers.

Meanwhile, industry sources report that LG Electronics Inc., despite having discussions with The Carlyle Group to form a consortium until as late as yesterday, decided not to participate largely due to the price burden.

Likewise, Hanon’s former owner Halla Group had considered taking funds from the state-run Korea Development Bank to finance the acquisition, but pulled out in the end.

HANON’S MARKET ATTRACTIVENESSHanon Systems’ market cap as of June 22 stands at 9.4 trillion won ($8.3 billion). The company’s operating profit last year was 315.8 billion won ($278.1 million) on revenue of 6.9 trillion won ($6.1 billion).

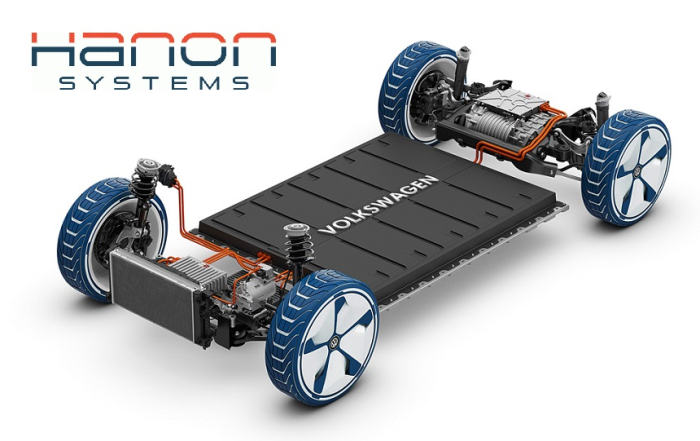

While the vast majority of Hanon’s revenue previously came from Hyundai Motor Co. and Kia Corp., the company has successfully widened its client pool to include Tesla of the US and Volkswagen of Germany.

Analysts say that the final purchase price of the 69.99% stake in the company is likely to be in the range of 7 trillion to 8 trillion won ($6.2 billion-$7.1 billion).

Industry watchers highlight that the current global thermal management systems market has only six major players including Hanon. They say that Valeo and Mahle will be able to challenge Denso’s leadership if any one of the two firms succeeds in acquiring the market runner-up.

Write to Jun-ho Cha at

chacha@hankyung.comDaniel Cho edited this article.