MBK Partners, one of the largest Asian private equity firms, is set to delist South Korea’s leading e-commerce operator Connectwave Co. from the junior bourse Kosdaq after buying an additional 29.6% stake through a tender offer, banking sources said on Monday.

The North Asia-focused PE firm started a tender bid on April 29 to acquire 16.6 million common shares in Connectwave for 299.7 billion won ($217.5 million) throughout May 24, sources said. MBK and the lead manager NH Securities Co. have set the offer price at 18,000 won apiece, up 15.61% from the share’s closing price on April 26.

Connectwave’s stock price surged 14.8% to finish at 17,880 won on Monday, nearing the tender offer price.

MBK and its affiliated persons aim to raise their ownership in Connectwave from the current 58.0% to 87.6%. Kim Ki Rock, founder and chair of Koreacenter Co. will remain the second-largest shareholder with a 9.3% stake. The remaining 3.1% is treasury shares.

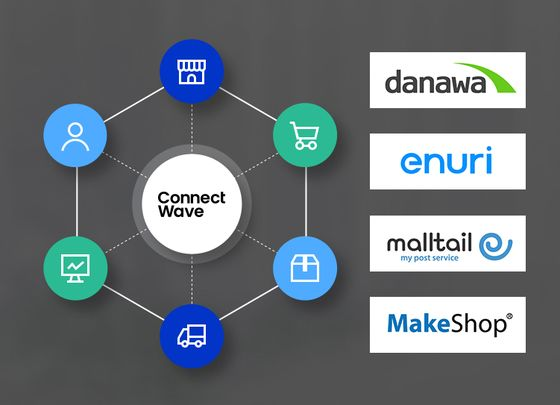

Connectwave operates leading e-commerce platforms in Korea including Danawa and Enuri, where users can compare product prices and move to online stores, Malltail, a website for cross-border ordering and shipping, and Makeshop, an online shopping business creation platform.

In a package deal, MBK acquired Danawa and Koreacenter, which owns Malltail and Makeshop, for 600 billion won in 2021 and launched the merged entity Connectwave in 2022.

Connectwave’s operating profit and revenue came in at 36.4 billion won and 460.2 billion won last year, respectively, up 109% and 35.6% from 2021.

Write to Ji-Eun Ha at

hazzys@hankyung.com

Jihyun Kim edited this article.