The global chip shortage is impacting South Korea’s COVID-19 test device makers. They are paying up to 10 times the normal price of semiconductor chips for their devices but are still failing to secure the desired volume.

According to industry sources on Jun. 6, a Korean test device manufacturer has recently halted its production line for the polymerase chain reaction (PCR) devices as it could not obtain enough microcontroller unit (MCU) chips. The MCU chips are used to maintain the constant voltage level of the devices.

The sources say that the Korean firm buys the chips from global companies like Texas Instruments Inc., STMicroelectronics N.V. of Switzerland and Renesas Electronics Corp. of Japan. The official websites of these global chip companies state that the buyers must wait for 35-47 weeks before they can get their orders delivered.

“Our global chip supplier said that we have to wait for about 10 months if we place our order now,” said a representative from another test device manufacturer.

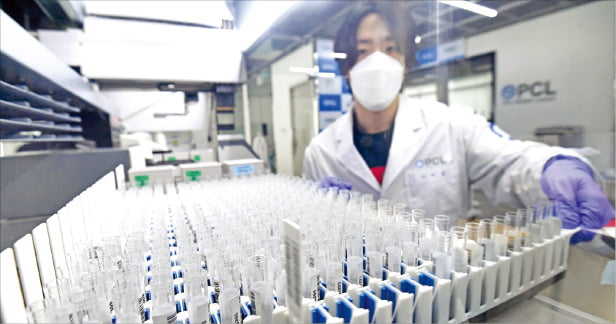

The diagnosis of COVID-19 uses test kits that collect samples from our body and the test devices that use the collected samples to confirm the infection. Companies like Seegene Inc., Bioneer Corp., MiCo BioMed Co. are the makers of the PCR test devices used for the molecular diagnosis method, the most prevalent method for COVID-19 diagnosis.

Recently, the demand for point-of-care testing (POCT) type of PCR devices have gone up rapidly. The POCT PCR devices are smaller, cheaper devices that can be used outside the hospitals and medical facilities. Each of the POCT devices use around 10 MCU chips, which take up only 2-3% of the manufacturing cost.

“It’s very frustrating that the shortage of these chips, which only cost about a few dollars each, is stopping us from selling our devices that can be sold at thousands, and even tens of thousands of dollars,” said the CEO of a test device company.

There is also the immunodiagnostic method of COVID-19 diagnosis, which use antibodies generated in our body against the virus. PCL Inc. is a leading maker of the immunodiagnostic test devices. PCL says it secured an inventory of chips enough to produce the devices for the next 18 months, while its rival SD Biosensor Inc. also secured an inventory enough for 3-6 months.

Sources report that some other makers of immunodiagnostic test devices have failed to secure enough volume in advance.

Industry watchers say that the test device makers are likely to suffer from the chip shortage for quite some period of time, as virtually all firms are trying to buy as many chips as possible.

“The MCU chips produced by STMicroelectronics were priced at 10,000 won ($9.00) per unit last year. Now it’s 100,000 won ($90.00). While we currently do have enough inventory of chips, our business might also suffer if the MCU chip shortage persists,” said PCL CEO Kim So-youn.

Insiders highlight that the shortage for the test device market might last longer than for the larger-sized industries such as smartphones and automobiles.

“We are not a priority industry from the views of the global chip companies. The auto and IT industries have much greater purchasing power than us. We are having difficulties in securing enough chips despite our efforts through other sources such as international trading companies,” said a test device industry official.

Write to Woo-sub Kim and Ju-hyun Lee at

duter@hankyung.comDaniel Cho edited this article.