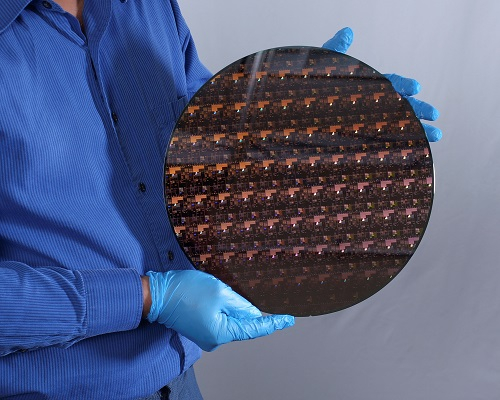

China, Japan and South Korea are racing for expanding wafer production as surging chip demand and increase in semiconductor makers’ capacity tightened supply.

China-based Zing Semiconductor is expected to ramp up its monthly production for 12-inch silicon wafers to one million units by 2025 from the current level of 250,000, according to foreign media reports. China is actively developing its wafer industry with an aim to overcome Japan in years by utilizing knowhow of solar silicon wafers to enhance semiconductor wafers.

Japan, a traditional wafer powerhouse, joined the expansion move. Sumco Corp., the world’s second-largest wafer maker, announced a plan to spend 228.7 billion yen ($2.1 billion) to raise 12-inch wafer production lines. The company plans to start mass production in 2023 and operate all of the lines in 2025 as it already secured five-year contracts to supply increased wafers from the extended lines. The global top wafer producer Shin-Etsu Chemical Co. considers capacity expansion. Those two Japanese companies dominate more than 50% of the global market.

SK SILTRON TO FOCUS MORE ON QUALITYSouth Korea’s SK Siltron Co., the world’s No. 5 manufacturer, decided to focus more on quality than quantity. The silicon wafer affiliate of SK Group plans to build a silicon carbide plant in Michigan, the US, and a 12-inch epitaxial wafer facility in South Korea. Both are expensive wafers for high-tech semiconductors.

SK Siltron’s market shares rose to 13% last year, similar to Germany’s Siltronic, from a single digit before.

The global wafer supply is expected to stay tight as makers fail to meet soaring demand for foundry and memory chips, according to the industry sources. Most producers are operating at full, while major chipmakers such as Samsung Electronics Co., SK Hynix and Intel Corp. are expanding their own capacity.

The global silicon wafer shipment rose to an all-time high of 3.5 billion square inches in the second quarter, beating the previous record of 3.3 billion square inches in the previous three months, according to data from Semiconductor Equipment and Materials International (SEMI).

SEMI expected the supply shortage to deteriorate further in 2022.

Write to Su-bin Lee at

lsb@hankyung.comJongwoo Cheon edited this article.