South Korea’s startup accelerator Klim Ventures announced Tuesday it has secured 5.5 billion won ($4 million) worth of bridge capital.

Bridge capital is temporary funding that helps a business cover its costs until it can get permanent capital from investors or lenders.

Dunamu & Partners and NEXON Korea participated in the funding round.

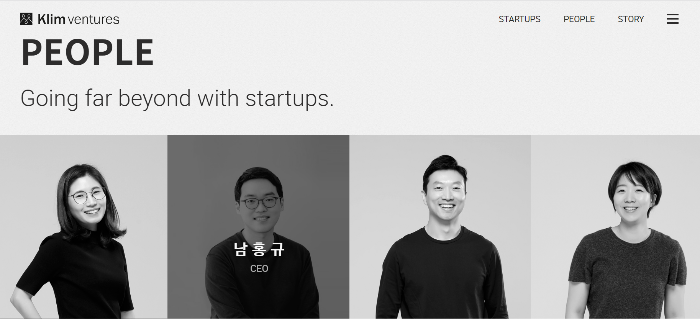

Klim Ventures' mission is to create a “healthy society.” The co-founders cut their teeth in startup and venture capital firms and founded Klim in 2020 with a focus on early stage startups.

The co-founders’ philosophy is that building trust with entrepreneurs at the early stages leads to exponential growth in the invested startups’ growth curve. In other words, they are in it for the long haul.

Klim also invests mostly with its own funding to win the trust of startup founders.

The accelerator has invested more than 30 billion won in artificial intelligence and robotics, digital healthcare and e-commerce.

It also operates Klim Park, a space dedicated to the startups it invests in, and established an ESG advisory committee to help them incorporate ESG principles into their long-term visions. On Nov. 2 last year, Klim appointed former CEO of Naver Kim Sang-hun as the chair of its ESG advisory committee, in addition to a seat on the board of directors.

Klim’s chief executive officer Nam Hong-gyu said he is excited to assist in entrepreneurs’ journeys and promised to grow as a company alongside the startups it funds.

Write to Jong Woo Kim at

jongwoo@hankyung.comJee Abbey Lee edited this article.