MBK Partners, a North Asia-focused private equity firm, agreed to sell South Korean Doosan Machine Tools at $2.1 billion to the country’s DTR Automotive.

MBK Partners signed a share purchase agreement (SPA) with DTR Automotive, a producer of batteries, tires and auto parts, according to investment banking (IB) industry sources on Aug. 13.

DTR Automotive was known to pay about 2.5 trillion won ($2.1 billion) to diversify its business portfolio. DTR Automotive, an associate company of the country’s Dong Ah Tire Group, beat a local apparel maker Sae-A in the final bidding with a higher offer.

Bank of America Merrill Lynch handled the deal.

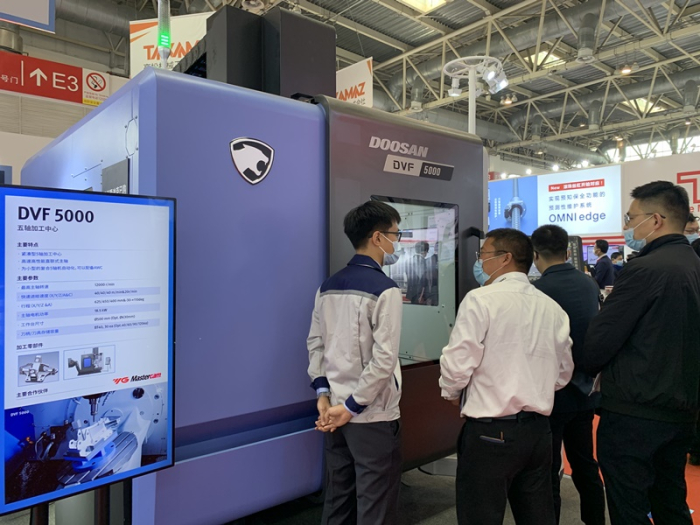

MBK Partners set up Doosan Machine Tools after buying the machine tool business from Doosan Infracore for 1.1 trillion won in 2016. Doosan Machine Tools increased earnings after the takeover, but the US-China trade war in 2018 hit its business in China and overall profits.

The private equity firm sought an initial public offering once in 2018 but withdrew the listing plan due to unfavorable market conditions. In 2019, the buyout fund tried a public sale, in which many companies at home and abroad including strategic investors in China were interested, but it also failed to sell the firm.

DTR Automotive was spun off from Dong Ah Tire in November 2017. The company supplies auto parts to global carmakers such as Ford Motor Co. and BMW. Its earnings improved on growing car demand and its storage battery production capacity expansion this year.

It is diversifying a customer base into the Middle East and Africa. Its earnings before interest, taxes, depreciation, and amortization (EBITDA) margin stood at an average of 12.4% in the recent five years.

Write to Chae-Yeon Kim at

why29@hankyung.comJongwoo Cheon edited this article.