Shares of South Korean online giants Kakao Corp. and Naver Corp. recorded all-time highs last week, ahead of their quarterly earnings results and on expectations for their future growth businesses.

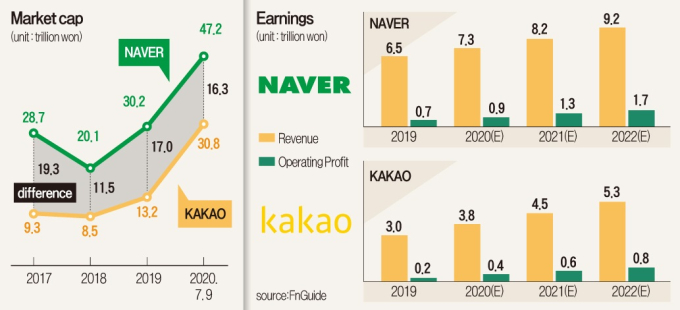

Naver touched its historic high of 308,500 won ($256) on July 10, up almost 90% since April. Kakao, the country's biggest mobile messaging app operator, also reached its all-time high of 368,000 won on July 10. The surge in price has bumped up Naver to the 3rd position in the country’s bourse with a 49.1 trillion won market cap followed by Kakao coming in 8th with a 31.9 trillion won market cap.

This is a drastic change from just three months ago in April when Naver shares dipped to 162,500 won per share and Kakao shares dropped to 157,000 won per share.

Covid19 is showing no signs of slowing down, and the prolonged social distancing circumstances have resulted in more use of 'untact' platforms such as e-commerce, messaging, banking, content, shopping, and games to overcome physical restrictions.

Untact is a term coined by combining ‘un’ with ‘contact’, commonly used in Korea when referring to a non-contact or non-face to face operation such as online platforms. In Korea, online giants Kakao and Naver stand at the forefront of the untact industry.

KOREAN ONLINE GIANTS

KAKAO, founded in 2010, initially began as a mobile messenger KakaoTalk (similar to US-based WhatsApp) which is now the leading messenger service in Korea. Since its inception, Kakao has grown into a platform giant expanding its business portfolio to include banking, entertainment, games, beauty, mobility, media, content, and more. Users can easily access a wide range of features via the messenger app KakaoTalk such as sending gift coupons, making hair shop reservations, ordering food, playing games, reading news, and more.

Its affiliate content platform KakaoPage is set to go public during the second half of the year. KakaoPage offers webtoons (digital comics), novels, and movies to a global audience. The platform is promising as Korean webtoons have gained much traction in Japan, the hub of digital comics. According to mobile data provider AppAnnie, Korean webtoons hold over 70% market share in Japan's digital comics market, outperforming traditional comic giants.

What began as a simple messenger app has now evolved into a heavyweight online platform in just 10 years.

In 2019, Kakao posted 3.08 trillion won ($2.5 billion) in revenue with 206 billion won in operating profit. During this year's January-March period, Kakao posted 868 billion won in revenue and 88.2 billion won in operating profits. According to FnGuide

, a financial data service provider, Kakao is expected to record 95.3 billion won in 2Q operating profits, double that of the 40.5 billion won from last year.

NAVER, founded in 1999, began as a search engine portal with features including Q&A forum, email, and blogs. Over the past two decades, the company has become the largest portal in Korea offering additional services including news aggregation, community forums, community networking service app BAND, e-commerce platform SmartStore, as well as global services including messenger app LINE and video messenger SNOW.

In 2019, Naver posted 6.5 trillion won in revenue with 710 billion won in operating profit. During this first quarter, Naver posted 1.7 trillion won in turnover and 221.4 billion won in operating profit. It is projected to report an operating profit of 228 billion won in the April-June quarter, up 2.93% from last year.

According to data analytics program MobileIndex, KakaoTalk recorded 35.59 million MAU and Naver recorded 31.6 million MAU.

UNTACT COMPANIES DOMINATE

It is evident that untact companies are taking over traditional business sectors. Their growth is accelerated by the global pandemic as online platforms provide novel options, accessibility, and convenience to users in addition to overcoming physical barriers.

For example, Kakao and Naver have expanded their presence drastically within the traditional retail and e-commerce market. According to Wisepp/Wiseretail, a user behavior analysis data provider, Naver posted 21 trillion won worth of transactions via its e-commerce platform in 2019, ahead of large e-commerce platforms Coupang and Gmarket which posted 17.7 trillion won and 16.9 trillion won, respectively.

Also, Naver posted approximately 6 trillion won worth of transactions via e-commerce platform during the first quarter of this year. This is an impressive record given that traditional retail giants such as Lotte Shopping and EMart saw a sharp decline in their market cap from a combined 16 trillion won from two years ago to 6 trillion won this year.

Kakao and Naver are expected to see continued profit growth amid the ongoing pandemic crisis, especially since each company has a tight grip over its respective markets making it difficult for latecomers to tap into the market.

The next core business for Naver and Kakao is financial services. Naver launched NaverPay in 2015, and Kakao introduced Kakao Pay in 2016, both featuring micro-transaction payment services.

In 2017, Kakao launched KakaoBank, a mobile app banking service, securing over 40 million users from its existing services. KakaoBank offers savings account and loan services. It is expected to launch an IPO near year-end.

Naver initially kicked off its financial operations via affiliate company LINE Financial in Japan. Last year, Naver decided to expand its financial platform in Korea by partnering with local insurers and banks, as well as the loan market which Kakao has already tapped into.

The two companies’ entry into financial services has led to a decline of almost 23 trillion won among Korea’s four largest bank holding companies including Shinhan Financial Group, KB Financial Group, Hana Financial Group, Woori Financial Group.

KAKAO VS NAVER

Investors interested in Kakao say the content platform has a greater potential in its business model scalability. Kakao boasts high user loyalty which can be utilized when expanding business portfolios such as content, entertainment, finance, mobility, and shopping.

This appears to be true as KakaoPage has gained much success backed by existing Kakao users.

“KakaoPage was the first to succeed in monetizing webtoon services with its feature ‘Wait then Free’, where users can read content for free after waiting for a certain amount of time, or they can pay to read in advance. Not only is it a powerful content platform, but its role as an IP holder is also strong. Kakao webtoon business has a potential value of 10 trillion won,” said Jeong-yeob Park, an analyst at Mirae Asset Daewoo Securities.

Regarding Naver, the search engine giant appears to have a greater advantage in terms of global scalability. While Kakao may be dominant in the local market, Naver has already tasted success in the global market and will be able to secure further growth.

For example, Naver LINE was the first domestic messenger service to achieve overseas success in countries including Japan, Thailand, Indonesia, and Taiwan. Currently, Naver is working to integrate its management with SoftBank affiliate Yahoo Japan through the LINE business. With almost 250 million combined users from LINE and Yahoo Japan, Naver will be able to achieve greater content scalability on a global scale.

Write to Jaeyeon Koh at

yeon@hankyung.com