Last month, South Korea's third-largest conglomerate SK Group agreed to sell its 21-year-old

baseball club SK Wyverns to the country’s leading retailer Shinsegae Group for 100 billion won ($88 million).

The deal followed a recent string of asset sales by the group, highlighting the energy-to-telecom group's shift from its traditional and once flagship businesses to focus on new growth areas such as electric vehicle batteries, hydrogen fuel, bio and chips.

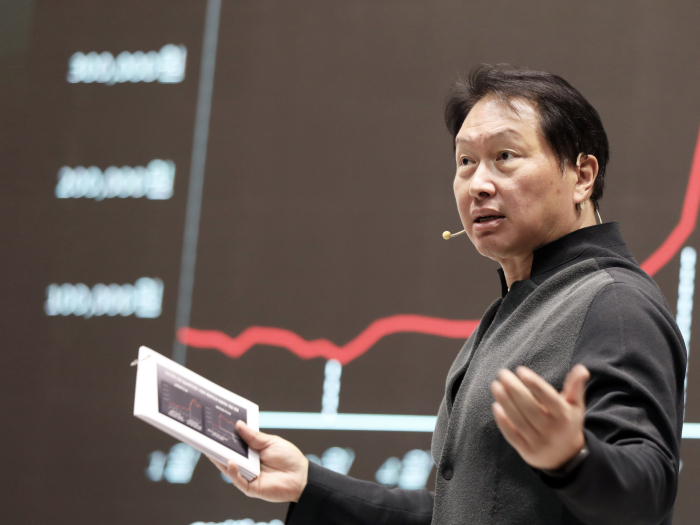

More importantly, the divestments reflect group Chairman Chey Tae-won's new business keyword proposed in a CEO seminar for the group's units in October 2020 -- financial story. The watchword follows his previous "deep change" and "design thinking" initiatives announced in 2018 and 2019, respectively.

Since last year, SK Group has been accelerating its efforts to make maximum use of its assets through initial public offerings and stake sales, as long as it keeps its management rights. Funding secured from the divestiture will be diverted into growth businesses, in particular, into assets that align with the group's environmental, social and governance (ESG) management aims.

"The assets of which we are unconvinced of their return on investment were first in line," a source involved in the group's asset sales told Market Insight recently.

SK Group had been spending 30 billion to 40 billion won per year on the baseball club SK Wyverns, equivalent to its annual interest payments for 1 trillion won in bank borrowings. The sports club may have contributed to the group's corporate image and employee morale boosting, but failed to convince its senior executives, including Chairman Chey, of its financial benefits.

“Rather than running a baseball club of which financial benefits we are unsure, we’d better invest the 1 trillion won into a promising business. That’s Chey’s message,” said a source of a Korean business group.

Under Chey's deep change initiative, the group has moved its focus into ESG-themed businesses such as EV batteries and their components, as well as hydrogen fuel cells, through a series of acquisitions, including a 9.9% stake in

Plug Power Inc. of the US.

Now it is sharpening its approach, digging into the financial benefits of each business, while increasingly embracing financial investors for its existing operations.

"If we can’t measure their benefits, we can't manage them, either. That’s Chey’s message," said an SK Group source.

As an example, the chairman had called for a precise calculation of the financial benefits of ESG-related activities, something similar to sales and operating profit reports. In December 2020, the group said its hydrogen business is expected to

create additional net asset value of around 30 trillion won by 2025.

SK Group's asset sales since 2019

SK Holdings is now

in talks with several private equity firms to sell a stake in a special purpose company established to buy a $1.6 billion stake in Plug Power, sources told Market Insight on Tuesday. SK Bioscience Co. is set to list on the Korea Exchange next week in

a 1.5 trillion won IPO.

If the planned IPOs and divestiture go through as planned, SK Group is projected to raise up to 8 trillion won this year, on top of its cash reserves of 11.9 trillion won as of the end of September 2020.

Analysts expect SK Group will continue to make a series of investments in the biotech industry and hydrogen supply chain, as well as ESG-themed companies.

SK Group's recent investments

Write to Jae-Kwang Ahn at

ahnjk@hankyung.comYeonhee Kim edited this article.