A US private equity firm Bain Capital and South Korea’s major petrochemical manufacturer Lotte Chemical Corp. were among the shortlisted candidates for a controlling stake in Iljin Materials Co., a leading Korean electric battery material maker up for sale with an estimated $3.1 billion price tag.

Citigroup Global Markets, which is handling the sale, selected four preferred bidders including Bain Capital and Lotte Chemical

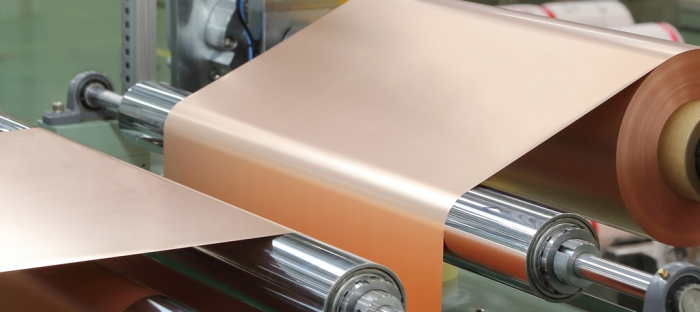

out of seven initial contenders for a 53.3% stake in Iljin, the world’s No. 4 maker of copper foil used for cathode collectors in EV batteries, according to investment banking industry sources on Wednesday.

Iljin has decided to sell management rights including the stake held by its Chief Executive Heo Jae-Myeong, the second son of the parent Iljin Group’s founder and Chairman Heo Jin-gyu.

The CEO was known to have decided to sell the stake as the company needs to expand overseas factories through continuous investment.TOUGH NEGOTIATIONSThe stake may be sold at as much as 4 trillion won ($3.1 billion), but negotiations for the deal will be tough, given the recent tumble in Iljin’s stock price with rising interest rates souring investor sentiment, IB sources said.

Iljin, whose customers include China’s BYD, as well as South Korea’s LG Energy Solution Ltd. and Samsung SDI Co., reported 69.9 billion won in operating profit last year based on sales of 688.8 billion won.

Last month, Samsung SDI inked a $6.6 billion contract to secure 60% of its needs for elecfoil, an ingredient for cell manufacturing, with Iljin.Bain Capital and Lotte Chemical were touted as leading candidates to take over Iljin, according to industry sources.

The PE firm successfully exited from investments in Hugel Inc.,

South Korea’s top botox maker, as well as Carver Korea Co., a skincare brand, with huge profits.

Lotte Chemical earlier unveiled plans to invest 4 trillion won in the battery materials business by 2030. Lotte, via its affiliate Lotte Fine Chemical Co., has already invested 300 billion won in another battery materials firm Solus Advanced Materials Co.

Write to Si-Eun Park at

seeker@hankyung.comJongwoo Cheon edited this article.