Micron Technology Inc., the world’s third-largest DRAM maker, raised its share in the shrinking DRAM market in the first quarter, with a milder sales decline than its bigger rivals Samsung Electronics Co. and SK Hynix Inc.

Micron expanded its market presence to 28.2% from 23.1% in the last quarter of 2022, overtaking second-ranked SK Hynix, according to research firm TrendForce.

The US chipmaker also beat SK Hynix by sales. Micron sold $2.7 billion worth of DRAMs in the January-March quarter, down 3.8% on-quarter.

By comparison, SK Hynix’s DRAM sales dwindled by 31.7% to $2.3 billion during the period. Its market share dropped to 23.9%, versus 27.6%.

Micron’s ascent came at the expense of the reduced market share of the two South Korean chipmakers.

Samsung and SK Hynix took a hit from a drop in shipments and average selling prices (ASPs), according to TrendForce.

Particularly, SK Hynix suffered double-digit falls in both shipments and ASPs, compared to the fourth quarter of 2022.

Sector leader Samsung saw its share fall to 43.2% in the DRAM market in the first quarter, versus 45.2% three months before.

Its DRAM sales plunged 24.7% to $4.2 billion over the same period.

Last year,

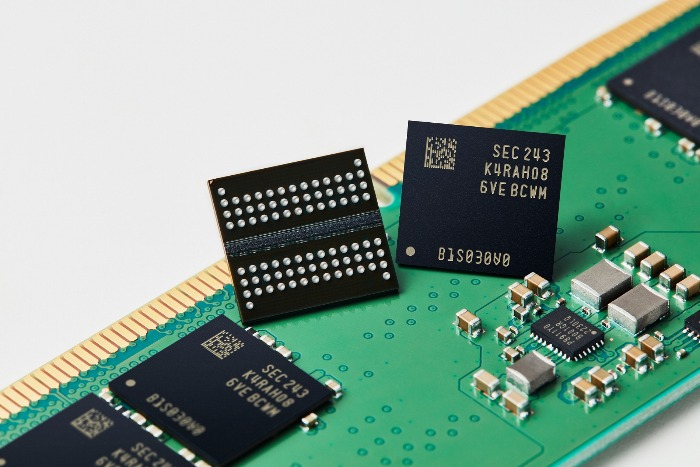

Micron entered the market of DDR5 DRAMs, challenging its two bigger rivals. The advanced memory chips are used to power next-generation Intel and AMD servers and workstation platforms.

Worldwide, DRAM sales tumbled 21.2% on-quarter to $9.7 billion in the first quarter of this year.

The research house said the top three DRAM makers will likely suffer losses from DRAM sales in the current quarter on the back of accumulated inventories and price falls.

Write to Jeong-Soo Hwang at

hjs@hankyung.com

Yeonhee Kim edited this article.