Some major South Korean institutional investors, including National Pension Service (NPS) and Korean Teachers’ Credit Union (KTCU), are set to invest a combined $390 million in Calpine Corp. Calpine is one of America’s largest generators of electricity from natural gas and geothermal resources with around 80 power plants across the US.

The Korean consortium has committed to a continuation fund of ECP Management, a US investment firm focused on energy transition and decarbonization infrastructure assets, according to investment banking sources on Thursday. ECP wholly owns Calpine and is set to create the continuation fund investing in a 20% stake in Calpine.

A continuation fund refers to a vehicle established to take on the portfolio assets of a fund that is nearing the end of its lifespan. When a general partner wants to hold onto the assets, it sets up the continuation fund and takes the assets from the older fund, thus extending the hold periods with existing or new limited partners.

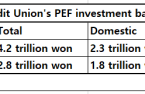

NPS and KTCU have respectively committed around $300 million and $90 million to the fund. Some other unknown Korean limited partners have also committed a relatively small amount of capital, according to the IB sources.

The Korean consortium’s commitment is understood as hedging against inflation via betting on infrastructure, as well as increasing environmental, social and governance (ESG) investments.

In May 2021, NPS announced

it will exclude from its portfolio new coal-fired power development projects both in Korea and abroad. It was the first official declaration by the world’s third-largest pension fund, managing 916.2 trillion won ($716.1 billion) in assets, to contribute to reducing greenhouse gas emissions. Calpine has also committed to increasing the use of renewables for power generation.

The deal will be NPS’ investment in the natural gas power plant business in eight years. In February 2014, the pension fund bought a 19.6% stake in a natural gas-based combined heat and power plant in Texas for $81 million but took a loss on the investment.

Founded in 1984, Calpine serves clients in the US, Canada and Mexico. It was listed on the New York Stock Exchange (NYSE) in 1996 but filed bankruptcy with $22 billion in debt in 2005.

The bankruptcy was in the aftermath of the 2000-2001 California electricity crisis with supply shortages caused by market manipulation. The US merchant power industry collapsed with nosediving electricity prices following the crisis, and Calpine’s stock price dropped to less than $0.3 at the time of delisting in 2005. In 2018, an ECP-led consortium completed acquiring a 100% stake in Calpine for $5.6 billion.

Write to Chae-Yeon Kim at

why29@hankyung.comJihyun Kim edited this article.