South Korean private equity firm STIC Investments Inc. said on Nov. 30 it will invest 1.1 trillion won ($843.1 million) to expand Korean elecfoil manufacturer Iljin Materials Co.’s production lines in Europe and the US.

The investment is comprised of 560 billion won through STIC’s co-investment fund and additional 500 billion won from acquisition financing.

The local limited partners in STIC Special Situation Fund II have participated in the co-investment deal.

The investors include the National Pension Service (NPS), Korea Teachers’ Credit Union (KTCU), Public Officials Benefit Association (POBA), Military Mutual Aid Association (MMAA), Korea Post, Korea Scientists and Engineers Mutual-Aid Association (SEMA) and National Credit Union Federation of Korea (NCUFK).

State-run Korea Development Bank and Korean major bank Kookmin Bank are bookrunners while Shinhan Bank is an underwriter for the acquisition financing.

STIC will participate in a 400 billion won paid-in capital increase for IMG Technology Co., an intermediary financial holding company for Iljin's overseas affiliates, and a 600 billion won paid-in capital increase for the elecfoil company’s European affiliate.

The 1 trillion won investment will support building two additional production lines at Iljin’s Malaysian affiliate, four new lines at its European affiliate and two additional lines at the US affiliate, STIC said.

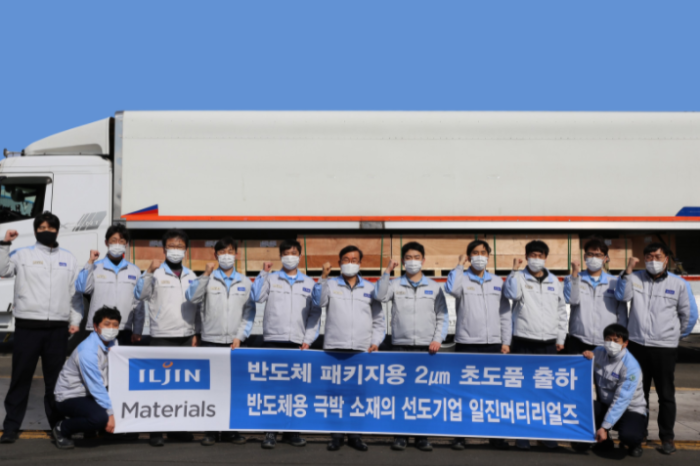

Iljin, producing copper foil used for lithium-ion batteries and semiconductors, attracted a 300 billion won investment through the STIC Special Situation Fund II in 2019.

The copper foil maker aims to increase its overseas elecfoil production capacity from the current 40,000 tons to 140,000 tons by 2025, including 60,000 tons for high-end electronic products manufactured in Europe.

Write to Jun-Ho Cha at

chacha@hankyung.comJihyun Kim edited this article.