South Korean private equity firm Hahn & Company is set to put a 100% stake in biofuel manufacturer SK Eco Prime on sale, with Goldman Sachs as a lead underwriter, according to investment banking sources on Oct. 7.

The sales price is expected to be around 500 billion won ($354.2 million), sources said. The PE firm is planning to draw bids with limited competition from some conglomerates and strategic investors looking for ESG investment opportunities.

The PE firm acquired SK Eco Prime, formerly chemical giant SK Chemicals Corp.’s biofuel unit, for 382.5 billion won in 2020 via its 3.8 trillion won third blind pool fund. The unit was rebranded as SK Eco Prime at the time.

The biofuel firm posted 574.9 billion won in revenue and 1.4 billion won in operating losses in 2021. Earnings improved compared with 236.5 billion won in revenue and 15.8 billion won in operating losses in 2020 when Hahn & Co. purchased the biofuel maker.

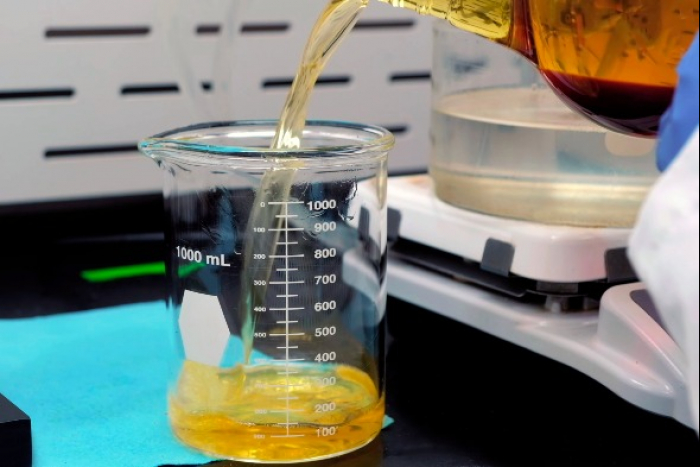

SK Eco Prime makes up 33% of Korea's biodiesel production, which is the largest market share. The company also manufactures and distributes bio-heavy oil.

Bio-heavy oil, mainly used for power generator operation, can reduce carbon dioxide emissions without needing extra equipment such as desulfurizers.

Hahn & Co. is expected to emphasize to potential buyers that demand for biodiesel and bio-heavy oil is globally increasing as many countries set up plans to reduce greenhouse gas emissions, according to sources.

The Korean government announced last year that transportation fuels should maintain at least a 3.5% biodiesel blending percentage from July 2021 to end-2023. The figure will rise to 4.0% during 2024-2026 and 4.5% in 2027-2029.

The percentage is even higher in Europe, around 8% on average.

Hahn & Co. will accelerate the sales procedures as it needs a quick exit and creation of its fourth blind pool fund, an IB source said.

The PE firm and local tire maker Hankook Tire & Technology last year attempted the sale of thermal management company Hanon Systems Corp., selecting Morgan Stanley and Evercore as co-lead underwriters. Hahn & Co. and Hankook Tire bought Hanon Systems in December 2014, with 50.5% and 19.49% stakes, respectively.

But the sales process has been stuck as the thermal management firm’s stock plunged from more than 20,000 won in January 2021 to less than 8,000 won in October 2022 amid global semiconductor supply chain disruptions.

Write to Jun-Ho Cha at

chacha@hankyung.comJihyun Kim edited this article.