Korea Investment Corporation (KIC)’s senior director for private equity is set to move to Mubadala Investment Co., a sovereign investor based in the United Arab Emirates (UAE).

Ahn Seung-gu, who has worked for over a decade at the South Korean sovereign wealth fund, recently confirmed her move to Mubadala and submitted a resignation letter to KIC, investment banking sources said on Friday.

Before joining KIC, Ahn worked for Tstone Private Equity, specializing in buyouts and mid-markets, from 2010 to 2013. She also served as an analyst at Morgan Stanley's special situations group in Seoul between 2008 and 2010. Ahn earned a bachelor's degree in economics from Korea University in 2007.

Ahn attended

The Korea Economic Daily’s ASK conference last October as a panelist. She said KIC is eyeing two strategies — secondaries that offer shorter duration and a faster return on investment; and deep value, focusing on stocks with low valuation measures.

Mubadala is the UAE's second-largest sovereign wealth fund, managing $276 billion in assets. The fund's aim is to generate sustainable financial returns for the government of Abu Dhabi.

The UAE plans more investment in Korea. The Persian Gulf country

will invest $30 billion in Korea across strategic businesses, including the nuclear power, defense, hydrogen and energy sectors, according to Korea’s presidential office and finance ministry in January this year.

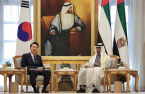

The investment will be led by Mubadala, Korea’s presidential office said at the time. The announcement came during a summit in Abu Dhabi between Korean President Yoon Suk Yeol and UAE President Mohammed bin Zayed Al-Nahyan.

Write to Byeong-Hwa Ryu at

hwahwa@hankyung.com

Jihyun Kim edited this article.